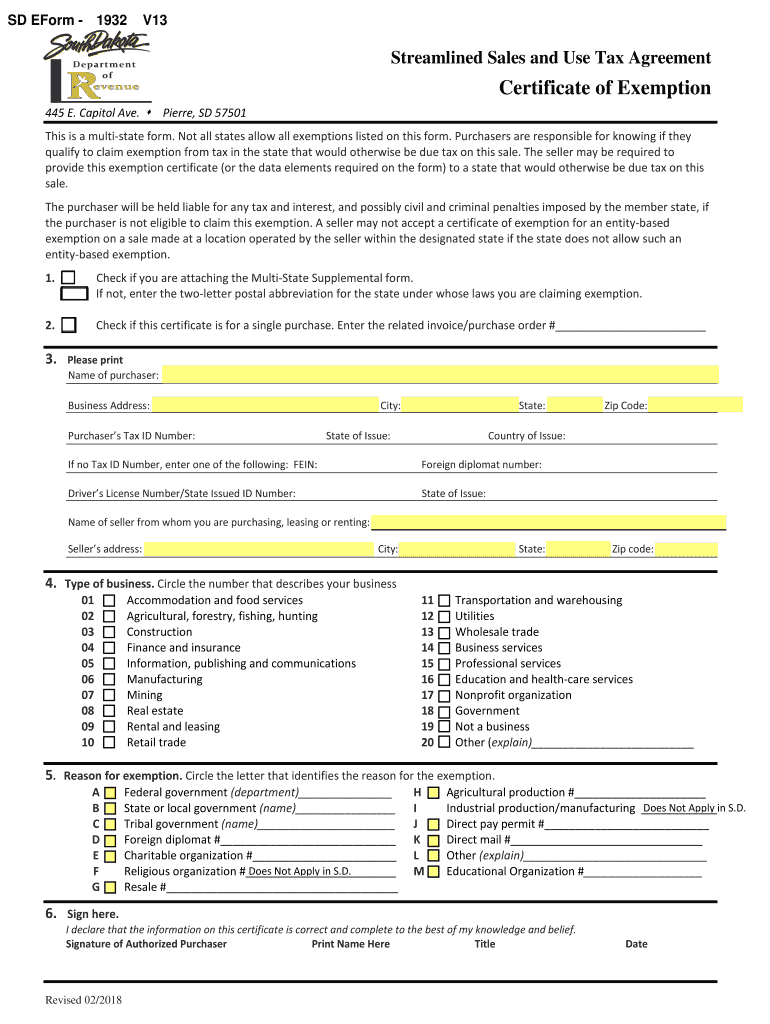

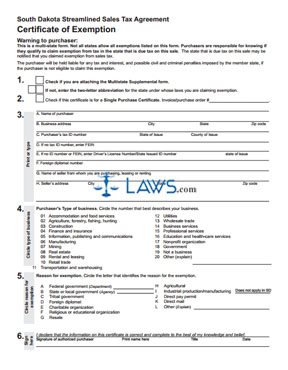

south dakota sales tax exemption form

North Dakota sales tax is comprised of 2 parts. South Dakota V.

Sd Eform 1932 2018 2022 Fill Out Tax Template Online Us Legal Forms

LA Resale Certificate Validation Louisiana.

. Tax Clearance Certificate Form. How to fill out the Georgia Sales Tax Certificate of Exemption. You do not need to update the forms you have on file but should use this form going forward.

Filling out the ST-5 is pretty straightforward but is critical for the seller to gather all the information. Free South Dakota Property Records Search. More about the South Carolina Income Tax Instructions Individual Income Tax TY 2021 This booklet includes instructions for filling out and filing your SC1040 income tax return.

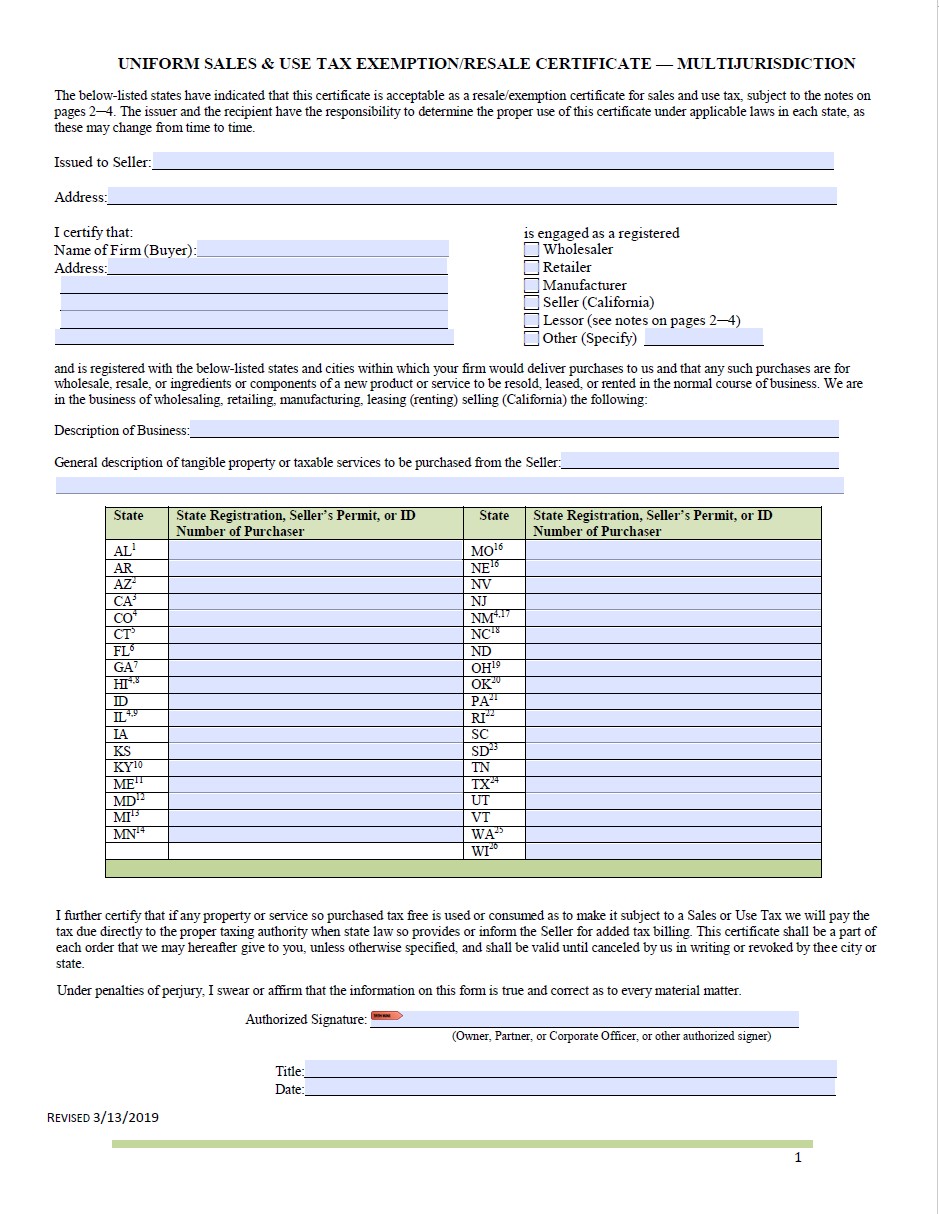

The process of tracking individual state sales taxes that enforce economic nexus can be daunting time-consuming and expensive. On June 21 2018 South Dakota vWayfair Inc. The Sales Tax Permit and Resale Certificate are commonly thought of as the same thing but they are actually two separate documents.

NC Registration Verification of Varying Types North Carolina. Overturned a 1992 Supreme Court ruling. The 2021 income limit for a single-member household is 13653.

MD Verification of Tax Acct. The limit for a multiple-member home is 18465. COVID-19 State by State Tax Analysis.

Indiana registered retail merchants and businesses located outside Indiana may use this certificate State Form 49065 to request exemption of a qualifying purchase from Indiana sales tax. Farm Machinery Attachment Units and Irrigation Equipment. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

The Georgia Department of Revenue created a Sales Tax Certificate of Exemption Form ST-5 to make things easier for documenting tax-free transactions. The certificate contains a list of exemptions on its face including tangible personal property that is sold to the Federal Government. We last updated the Indiana General Sales Tax Exemption Certificate in January 2022 so this is the latest version of Form ST-105 fully updated for tax.

In the year since the decision more than 40 states have enacted remote sales tax laws that base a sales tax collection obligation solely on economic activity economic nexus. How to use sales tax exemption certificates in South Dakota. Although managing sales tax exemption certificates may seem like a simple process anything associated with sales tax proves otherwise.

Sales Property Tax Refund for Senior Disabled Citizens. Must meet the annual income requirements. KS Exemption Certificate Verification Kansas.

The Streamlined Certificate of Exemption Exemption Certificate has been updated. Learn More About Sales Use Tax. Instructions for purchasers and sellers are on the back side of this form.

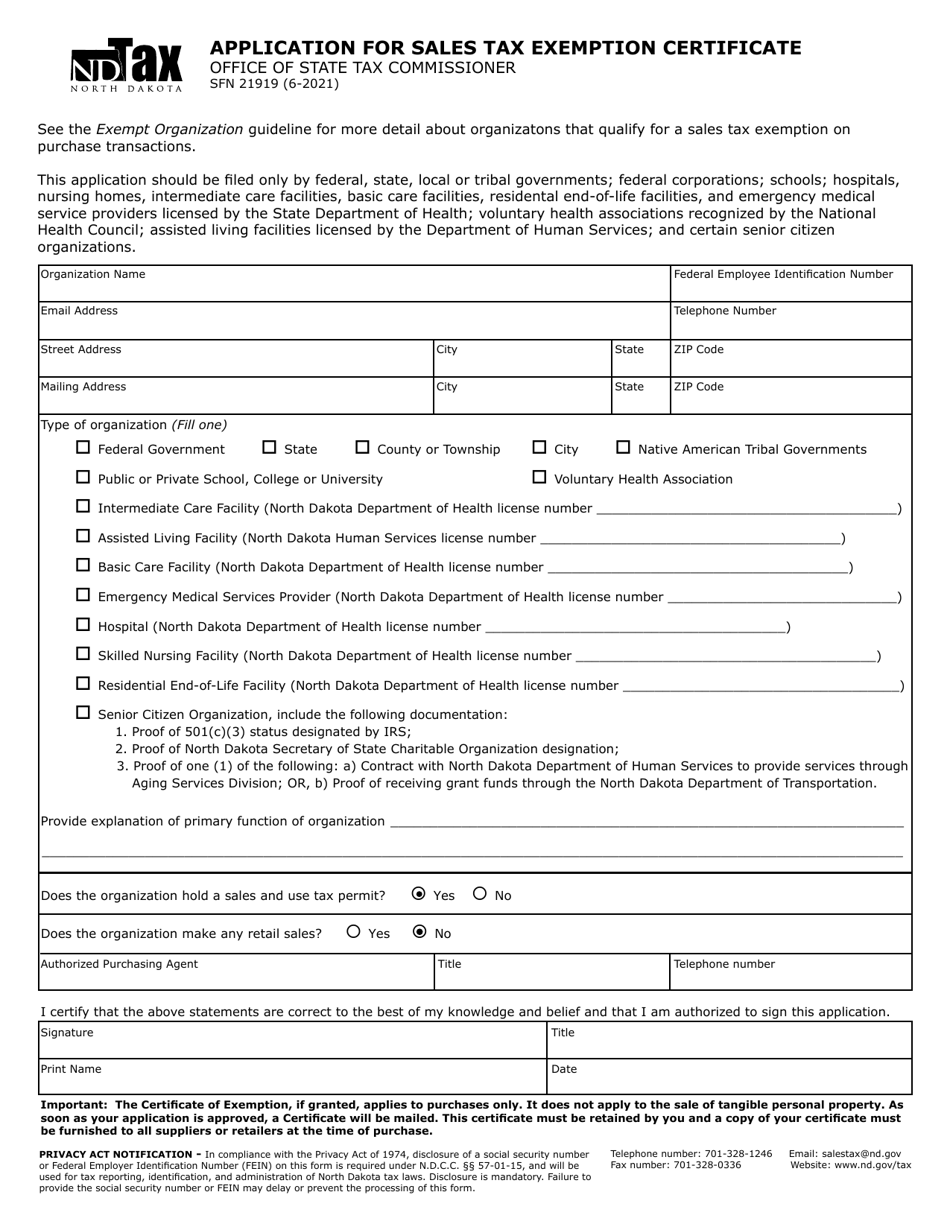

Property Tax Exemption for Paraplegic Veterans. North Dakota imposes a sales tax on retail sales. MN Tax ID Inquiry Minnesota.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. The sales tax is paid by the purchaser and collected by the seller. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Find South Dakota residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more. This form contains the same information as the prior form. States can now require ecommerce businesses to pay sales taxes where those businesses have an economic presence or nexus.

Contractors are only allowed to issue form ST-1201 when purchasing materials used in a construction project and this form has very. Must have been a South Dakota resident the entire previous year. This certificate provides an exemption to purchasers when they are working together with a governmental agency.

If your company sells taxable. For other South Carolina sales tax exemption certificates go here. In June of 2018.

ND Sales Use Tax Permit Inquiry North Dakota. Find laws regulations and general information on South Dakota sales and use tax. Gross receipts tax is applied to sales of.

The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell. And now that states can tax out-of-state sales your business may have new sales tax collection obligations. MS Sales Tax Acct No.

We last updated the Form SC1040 Instructional Booklet in January 2022 so this is the latest version of Income Tax Instructions fully updated for tax year 2021.

Form 21919 Application For Sales Tax Exemption Certificate

Sales Tax Exemption Sd State Auditor

Sd Eform 1932 V10 Fill Online Printable Fillable Blank Pdffiller

Business Leaders Think These Are The Best States For Education Business Leader Education Historical Maps

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Printable South Dakota Sales Tax Exemption Certificates

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Sdform Fill Online Printable Fillable Blank Pdffiller

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Free Form Sales And Use Tax Guide Free Legal Forms Laws Com

E 595e Web Fill 12 09 Fill Online Printable Fillable Blank Pdffiller